amazon flex tax documents canada

Tap Forgot password and follow the instructions to receive assistance. Knowing your tax write offs can be a good way to keep that income in.

The Definitive Guide To Amazon Flex Pay Ridester Com

How to Calculate Your Tax.

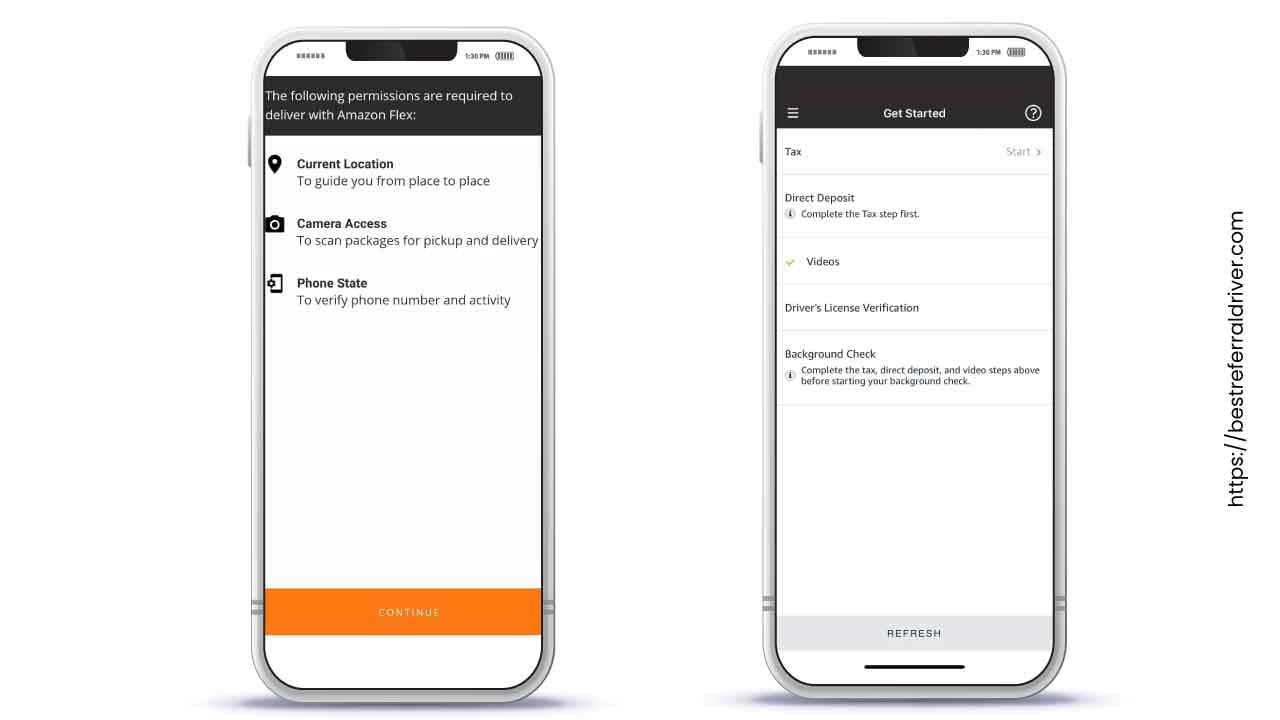

. Driving for Amazon flex can be a good way to earn supplemental income. Most drivers earn 18-25 an hour. The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or.

Select Sign in with Amazon. How Much To Put Away For Quarterly Taxes. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after becoming aware of the FTCs investigation in 2019.

What is a 1042-S tax form. Go to your phones My Files or Downloads folder and tap the Amazon Flex icon to install. If you get a check please cash it before January 7 2022.

Click Download to download. If your payment is 600 or more you will receive a. No matter what your goal is Amazon Flex helps you get there.

Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. We would like to show you a description here but the site wont allow us. Or download the Amazon Flex app.

The amount of tax and National Insurance youll pay will depend on how much money is left over after deducting your flex expenses tax allowances. Gig Economy Masters Course. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906.

Go to Settings General Profiles or Device. If this is your first year self-employed most Amazon Flex drivers are safe setting aside 25 to 30 of their pay. After your first year you can pay based on your previous years.

The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes. Sign in using the email and password associated with your account. The forms are also sent to the IRS so take note if youve made more than 600 in the.

Taxing authority called the Internal Revenue Service or IRS requires Amazon to send to certain payees. Increase Your Earnings. Form 1042-S is an information statement that the US.

Click ViewEdit and then click Find Forms. 12 tax write offs for Amazon Flex drivers. If you use an iPhone set up trust for the app.

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

23 Apps Jobs Like Amazon Flex To Earn Money Making Deliveries Appjobs Blog

Filing Tax Returns For Delivery Drivers Tips And Advice Turbotax Tax Tips Videos

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Doordash Taxes Does Doordash Take Out Taxes How They Work

How To Apply For Amazon Flex Driver Jobs Career Info

Deltassist Volunteers Here To Help At Tax Time Surrey Now Leader

Amazon Flex Support How To Easily Contact Amazon Customer Service

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide

Common Usa Tax Forms Explained How To Enter Them On Your Canadian Tax Return 2022 Turbotax Canada Tips

Frequently Asked Questions Us Amazon Flex

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Cloud Outage Hits Major Websites Streaming Apps Reuters

Tax Guide For Self Employed Amazon Flex Drivers Goselfemployed Co

Us Canada Ecommerce Sales Tax Guide

Everything You Need To Know About Amazon Flex Gridwise

Canada Rules Amazon Flex Drivers Are Employees And Can Unionize Flex Drivers Can Do Way Better R Amazonflexdrivers